Data driven retail

How merchants can use tech to run smarter stores

Retail is the ultimate marketplace problem. You win if match supply to demand better than anyone else. And yet, that simple process gets stretched across months of uncertainty; planners who decide how much to make, buyers who choose what to stock, merchandisers who curate assortments for maximum sell-through.

I’ve spoken with dozens of store owners and retail experts across the US, and reflected on my own time working in both retail and tech. The contrast is stark: in tech, everything is measured and optimized in real time; in retail, inventory tracking, and forecasting are still painful, and error prone.

Meanwhile, the tools gap between big retailers and independents keeps widening. The largest players have armies of analysts and sophisticated systems; smaller stores are left with spreadsheets and gut instinct.

But they don’t have to be. Most stores already sit on top of tons of unexplored insights. Their next best seller is already in their data.

This post is about small steps that can dramatically improve data driven ops and decision making. It’s an overview of where the process pains are, how independent retailers can elevate their ops with new tools, and what I’m building to make retail slightly better— one tiny step at a time.

Let’s dive in.

Smarter merchandising

Working with customers at a major retailer in SoHo, I learned firsthand how broken store tech can be. I couldn’t see what was selling the best, or what was about to hit the floor. I had no way of knowing which items to spotlight for the highest chance of closing a sale. That meant I couldn’t answer most of the upsell questions customers cared about. Instead, I was relying on memory and gut instinct, while constantly feeling a step behind. Our collections often felt mis-matched. What was relevant wasn’t what we were pushing.

Customers noticed. One woman even called me out in a Yelp review for not knowing if a particular style was in store. Since then, walking through boutiques in Miami, LA, and New York, I can sense which stores still don’t know their own best sellers.

Now contrast that with the leaders: Reformation, Zara, Aritzia, Revolve and beyond. These stores operate around sell-through. Stores are tuned to their neighborhood taste. If a style takes off in SoHo, store managers flag it and HQ adjusts supply. Fast movers shift to the front, slower ones disappear. Data reveals what’s selling, and the bestsellers rise to the top of the assortment. Supply follows demand.

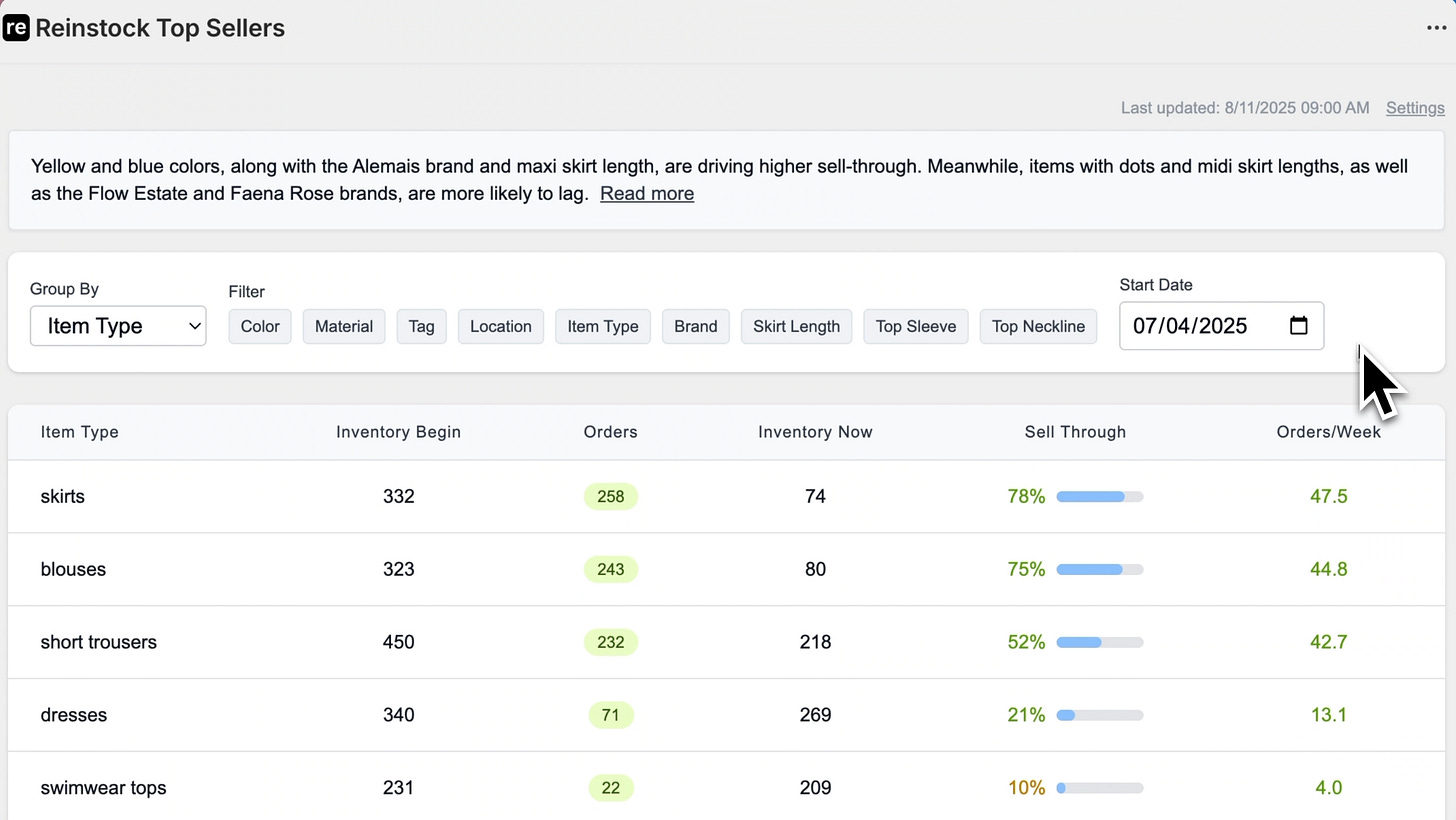

That same level of clarity shouldn’t just belong to Zara or Revolve. Independent stores deserve it too. That philosophy is why I wanted to build a sell-through app for merchants: it categorizes products, analyzes performance, and delivers clear reports by location, color, material, and more. With one click, independent operators can finally see what’s truly selling and why, so they can run their stores with as much science to their art as they wish.

Smarter demand planning

Working on inventory operations for a retail brand, I watched the same blind spots play out on a bigger scale. We spent weeks building forecasts in Excel, placing massive bets on inventory performance for months ahead. A single misstep could lead to stock-outs, overstocks, or both. Real cash was on the line, with no guarantee the inventory would actually turn into revenue.

How do you decide how much to buy or make, especially over a high breadth of SKUs, 90 days in advance? How do you do it when location, product category, seasonality, and marketing spend all play critical roles?

Walmart, Amazon, and Target offer great examples. These giants improve forecast accuracy with machine learning. Their models go beyond straight line growth forecasts in Excel; they factor in seasonality, promotions, weather, holidays, and demographics to predict demand by SKU. Amazon can even auto-adjust marketing spend towards trending products.

Yet, discretionary fashion is even more complicated. We can see on Pinterest, Google Search trends and online trend reports that styles move quickly and actively shape demand. What good is my forecast for dresses overall, if my actuals are driven by red minis because that style is 20% more popular this season? What if next season that switches to yellow?

There’s now a plethora of independent trend analysts doing style reports on weekly and monthly trends. And while reading about how butter yellow spiked in search interest +200% WoW may helpful in storefront placements, the best data towards better planning is your own.

Smarter supply chains

It’s not just about how much to order, it’s also about knowing when to order and making sure it gets there on time.

Suppliers abroad are known to be unpredictable. Lead times are already strained from ocean shipping alone, but adding in supplier delays further adds error to the process.

And while I’m super excited about the potential to manufacture clothing with robots in the US, that’s still far way (AI can generate art but can’t fold knits.. bummer). What we can do today is obsess over orders and their delivery times.

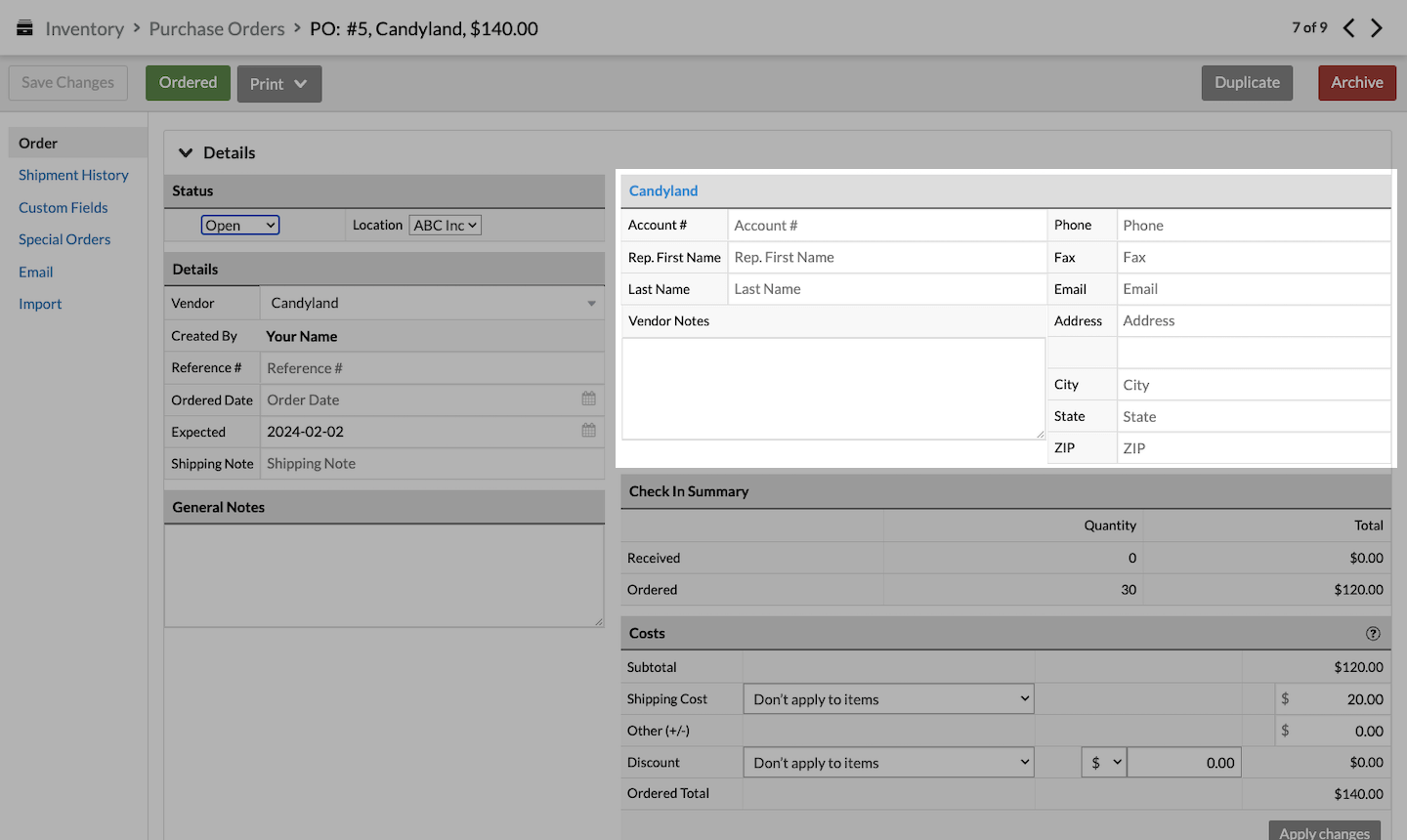

Smart retailers track vendor gaps in delivery times, adjusting POs based on supplier reliability. Zara builds dynamic risk models based on factory reliability. Apple tracks supplier reliability scores.

Especially for new or scaling brands, a growth year can mean constant reorders. For independent retailers, Shopify apps help with restock alerts based on lead time and automating supplier purchase orders. Lightspeed can automate purchase orders as well.

Starting with tracking supplier lead times is the first step to smoother reorders and lower stockout rates.

Smarter buying

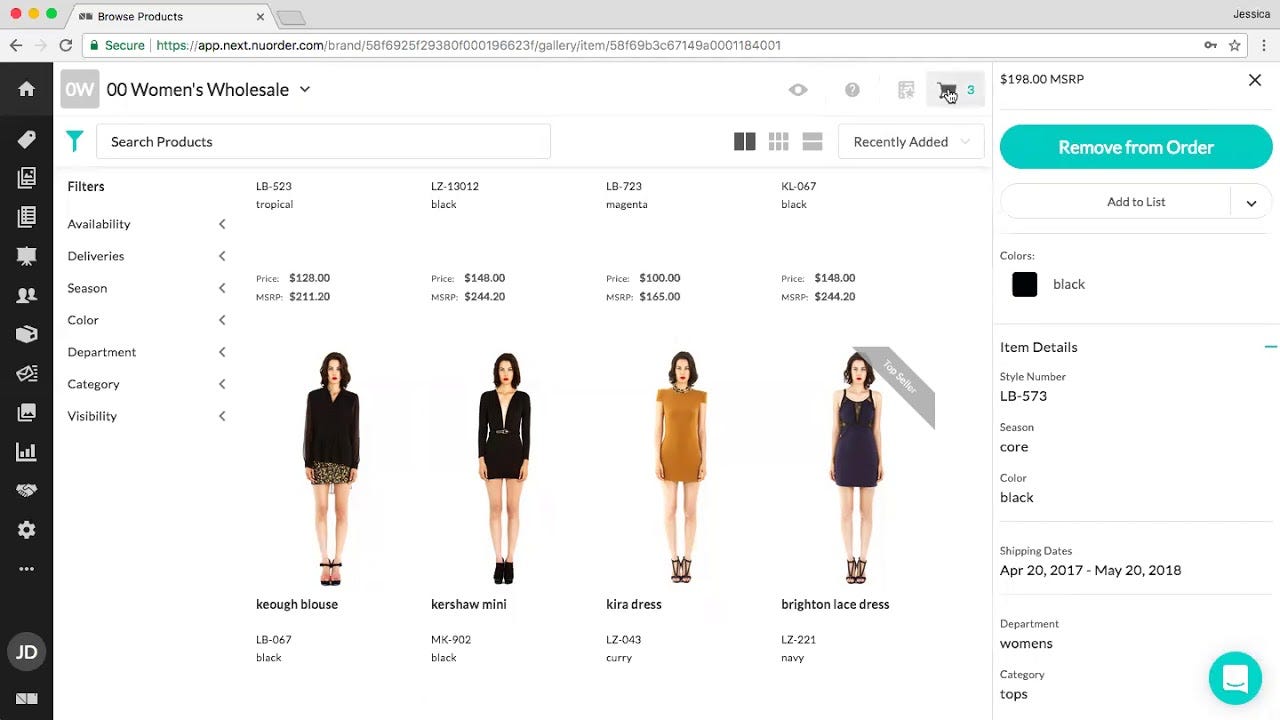

Not every restock is a manufacturing constraint. The majority of fashion is still built around the buying process. Brands compete for placement with key stores for reputation, revenue and simpler operations. Platforms like JOOR and NuOrder digitize the showroom, offering polished presentations to buyers. Faire connects brands with retailers to coordinate large orders. And trade shows remain as active as ever.

But how do buyers decide what to stock in their stores? Famous boutiques like Kirna Zabête insist it starts with knowing your customer. The work is obsessively observing what people actually wear, knowing their customers’ preferences better than everyone else; especially by location, which is where physical stores have an advantage over e-commerce.

Instead of guessing, smarter stores can lean on their own sell-through data in an organized and actionable way. If dresses from a certain brand outperformed the category last season, and the lift came from a particular style, they arm themselves with these insights.

Smarter operations

Independent retailers don’t have the luxury of large analyst teams. They don’t have endless hours to track inventory, forecast supplier lead times, analyze styles by SKU, or obsess over sales data.

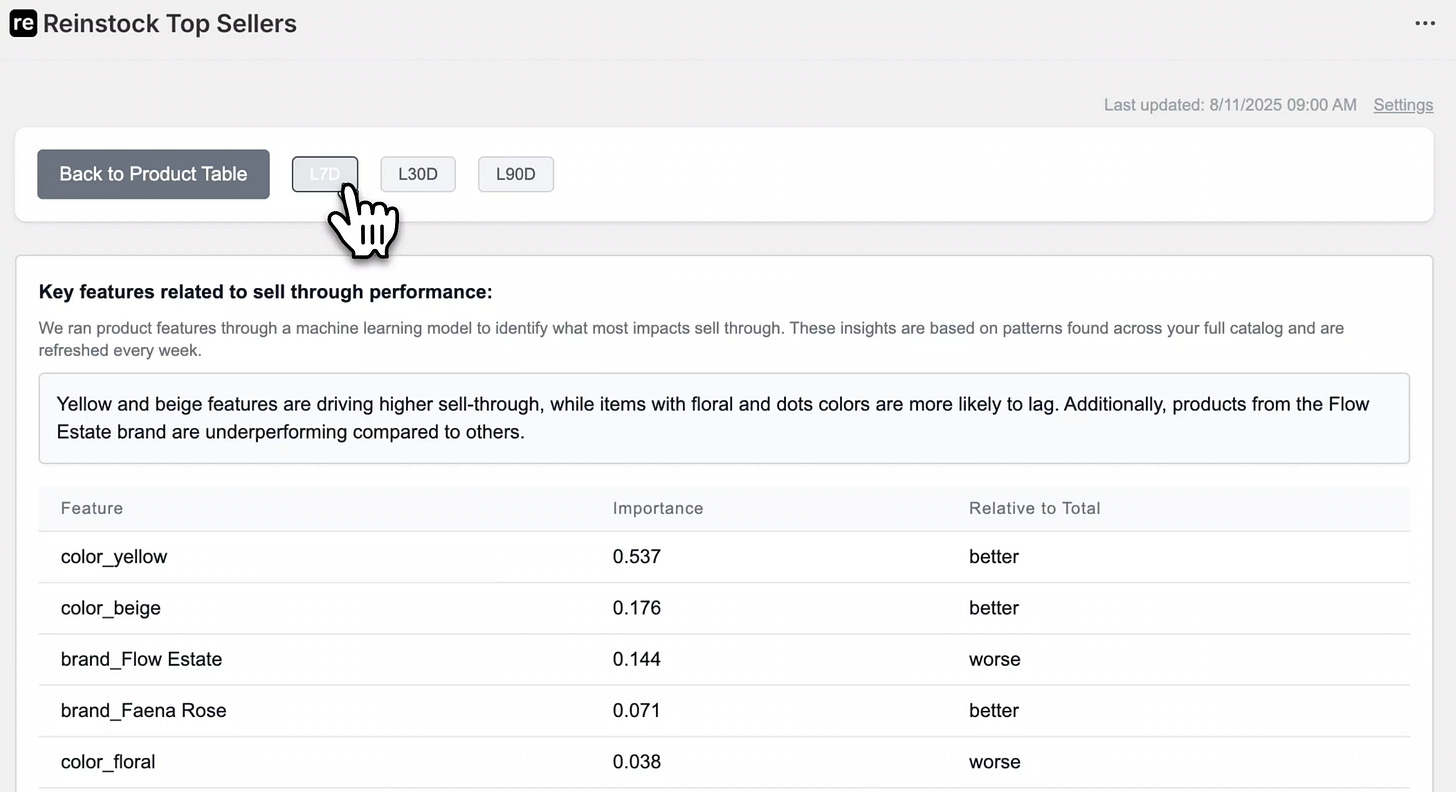

When I first started building sell-through reports, I’d lose hours digging through filters just to find the patterns. I thought, there must be an easier way to get the key insights quickly. This is why I layered in machine learning to identify which factors drove sell-through, then used a large language model to summarize the results in a clean way. Now, instead of drowning in numbers, I get a weekly readout: clear, custom insights that surface what matters most. Like a pocket merchandising analyst, but on demand.

Thanks for reading

I don’t have all the answers, but I know this: independent stores deserve the same clarity and tools as the biggest players. Reinstock is one small step in that direction, built out of my own curiosity, a lot of listening, and many late nights iterating. Reinstock is now on Shopify, available on demand to support independent stores with style level sell-through reports. If you’re a retailer, a buyer, or just someone who loves good ops, I’d love to hear your perspective.