Made in China

How China's manufacturing shaped the US retail industry

Well, this sucks. This tariff trade war is devastating. It’s going to hurt business owners, employees, and families across America. Hundreds of thousands may lose their homes. Many more will lose their jobs. We’re staring down the barrel of recession, inflation, and the erosion of global trust in the US dollar.

Over the month, US tariffs on Chinese imports have skyrocketed to 145%, and China has retaliated with 125% tariffs of its own. It’s a bitter, tit-for-tat escalation that’s nearly impossible to track — a self-inflicted (!!) shock to our supply chains and capital markets.

And the only reason we saw a pause from the US? Treasury yields climbed so high they started threatening the US budget and debt repayments — so Trump was forced to cool it. That is, only after Jamie Dimon spoke up about recession risk on Fox Business, of course.

Meanwhile, small business owners across the country are frozen. They’re facing brutal uncertainty, import-driven cash flow collapses, and in many cases, the risk of losing everything — even their homes. While they scramble to survive, banks and high-frequency traders are quietly profiting from the chaos and bringing in record trading earnings (more volatility = more arbitrage = more trading gains). Companies close to the President are getting exemptions while small businesses suffer.

Honestly, it is chilling. So let’s dive in.

Made in China

Chinese manufacturers are having a moment on Rednote and TikTok. They're posting behind-the-scenes reels claiming to produce luxury goods for major brands—often from the same factories—at a fraction of the price. Some even expose production costs and flaunt their ability to replicate high-end items down to the stitch, just without the logo. It’s the quiet part said out loud.

So, what’s in a name? Under EU law, a product can be labeled “Made in Italy” if its last substantial, economically justified transformation happens within Italian borders. That means as long as the final and significant step of production occurs in Italy—whether it's assembling, tailoring, or finishing touches—the product qualifies as long as it has been significantly altered or changed from its parts.

Either way, it’s hardly a secret that significant luxury production depends on China. Brands like Prada, Coach, Michael Kors, and Tory Burch have acknowledged manufacturing there either in interviews or financial reports. Many newer luxury labels wrap themselves in the aesthetic of Italian or French craftsmanship—while openly producing smaller goods, accessories, or components in China. LVMH had openly expanded its craftsmanship training program there recently.

Back in the early 2000s, Miuccia Prada was ahead of the curve, praising the quality of Chinese production and shifting 20% of Prada’s manufacturing there. “Sooner or later, it will happen to everyone,” she said. “Because [Chinese manufacturing] is so good.”

Nevertheless, there is no official confirmation of manufacturing operations in China for Louis Vuitton—and there’s no mention of it in their financial reports. As for Hermès, the Acquired podcast did a great deep dive into the brand’s singular approach to craftsmanship, emphasizing techniques that are uniquely Hermès and nearly impossible to replicate. I highly doubt their goods are made in China.

The viral videos circulating online are likely exaggerated with dupes, not authentic pieces. And the reason these manufacturers are exposing them? Probably because they’re not producing for those top-tier luxury brands—they’re supplying smaller, lesser-known labels that aren’t mentioned.

But it all speaks to something bigger.

The way I see it, the TikTok manufacturers’ claims are more than just flexes—they’re a direct callout to Western branding dominance. China already owns the supply chain, the craftsmanship, the manufacturing scale—and with Chinese consumers now driving a third of global luxury demand, they increasingly own distribution too.

The one thing China historically lacked was branding. But that’s changing. There’s a renewed sense of confidence, and new names like Icicle, Neiwai, and more are stepping into the spotlight. These brands aren’t just functional—they’re aesthetic, narrative-driven, and priced for high gross margins just like their Western DTC counterparts.

China is ready to call the shots.

China empowered direct to consumer

But let’s take a step back. What Chinese factories did do for Americans was directly empower the direct-to-consumer boom of the 2010s and 2020s. Chinese factories offered low unit costs, small minimum order quantities, and flexible customization; enabling rapid, feedback-driven production cycles. This in turn, lowered the barrier to entry. Up until April 2nd, anyone with a website, a photographer and a minimalist logo could easily launch a store. We got more stores, more choices, more Instagram ads, leading to more competition and lower prices.

This agility fueled thousands and thousands of new Shopify stores, Instagram-native brands, and TikTok Shop sellers. In 2010, there were 10K Shopify stores, with ecommerce at 4% of retail. By 2024, there were 3M Shopify stores in the United States, with ecommerce at 16%.

De minimis and global warehouses

Then, things got even more interesting. A wave of new business models emerged, built around squeezing every drop of efficiency from the supply chain. Shein, Temu, Cider—and nearly every TikTok dropshipper—leveraged a little-known US import rule called de minimis.

Originally designed for individual consumers shopping abroad, the rule allowed shipments under $800 to enter the US duty-free. No customs delays, no taxes, no paperwork. It was essentially a loophole that supercharged global e-commerce—and fueled an entire ecosystem of $5 tops, $15 dresses, and race-to-the-bottom pricing.

Here’s the thing – this setup means the key isn’t even about being US made, it’s about when and at which point you ship from abroad. US or non US, all types of brands operate without US warehouses. Instead, they ship direct-to-consumer from Asia, leaning into fast fulfillment, cheap cross-border logistics, and full exemption from domestic warehousing.

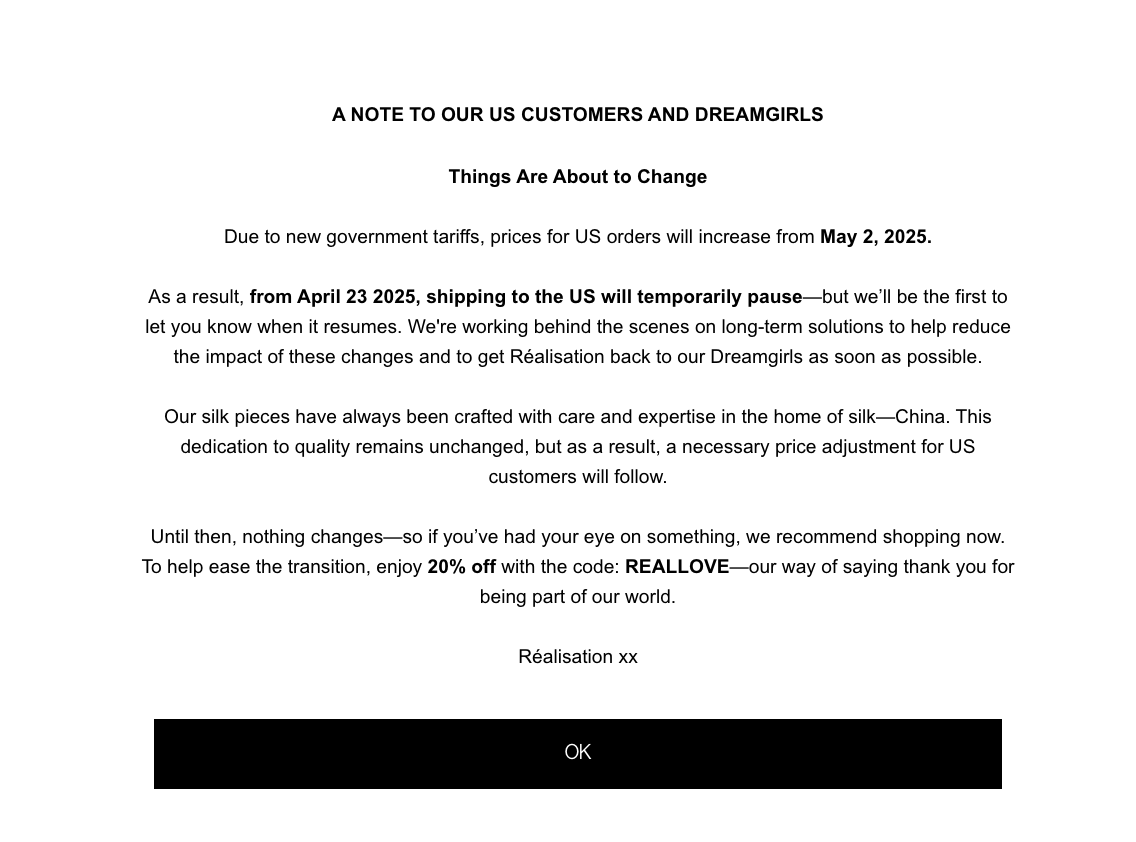

But that loophole is now closing. Starting May 2, de minimis will no longer apply in the same way. That’s likely why one of my favorite brands—Réalisation Par, an Australian label that ships from China—has announced it will increase prices on that date.

Global warehousing with China supply and US consumers has to be the worst set up for retailers now. Stores without US warehousing will be taxed not just on raw materials or manufacturing costs, but on the retail value of each product, every time it enters the country — often calculated at checkout or based on declared price. This means storing globally can make an entire business model unsustainable.

US production hasn’t caught up

So why can’t more retailers manufacture in the US? Well, some do. There’s been a quiet rise in LA manufacturing, with popular factories like TEG offering accessible production with low MOQs, especially popular among indie brands. It helps — but only so much. Today, as much as 98% of apparel is still made outside of the US.

Even then – similar to Made in Italy, US Made items often involve components, trims, or raw materials sourced abroad, which are still subject to tariffs when imported. Domestic production and warehousing soften the risk, but they don’t eliminate it.

Worse, the fewer brands that can afford to operate with Chinese supply chains, the fewer viable business models we have. Fewer orders, fewer factories. The reverse flywheel kicks in. LA production doesn’t scale without demand.

This brings me to the Busy Baby company covered by the New York Times. They can’t move manufacturing to the US even if they wanted to. Setting up their own factory would cost millions—completely out of reach. And working with American suppliers? Not an option either. No US manufacturer currently has the capability to produce their product.

Even if they could find one, they wouldn’t survive the transition. With just three months of inventory and a six month time to set up with a new factory, and debt on the line, there’s no room to rotate, no safety net to catch them.

And that’s the part that stings: if this whole trade war theater is really about helping American businesses and consumers—where’s the heads-up? The advisory support? The financing help to actually make that shift?

Worse, as businesses are increasingly serving global customers — rising reciprocal tariffs on US companies would make it harder for Americans to sell goods to EU, Australia, Asia and beyond. Even if I have a US warehouse, US suppliers — I am getting bigger costs from selling my American goods globally.

Americans’ only line of defense was (presumably) China dumping Treasuries and Jamie Dimon going on Fox Business.

What this means

Any small or mid-tier retailer selling to the US with suppliers in China, international warehouses, or thin margins is hurting right now.

Higher priced, bigger retailers can have some breathing room. For more premium apparel brands, margins can get as high as 80%. They’re not untouched, but they can absorb, adjust, or reprice and have room to breathe; especially when most of the industry is changing and they’re most likely to stay afloat. Some may even gain share as others scramble.

Many are still shipping old inventory or haven’t updated pricing structures yet. If things continue, we’re likely to see a 4–6 month lag in premium apparel before most consumers feel this in pricing.

Some businesses placed orders to China and paid for inventory before the tariffs went in effect. Now they’re stuck with 2x the cost of that inventory to get it into the country. If I ordered $100K worth of inventory that I paid for to drive revenue for the next 3 months — I am now stuck having to pay an extra $125K just to get the goods. This type of giant surprise cash bill can be devastating, and some SMBs are even choosing to shut down.

This sucks

Let’s put our Michael Burry hats on.

There are an estimated 3.5M of retail trade SMBs today, and assuming 50% (it can be as high as 70% according to FedEx) rely heavily on imports from China, that gives us nearly 2M that may not survive a shock without passing on prices, or shifting supply. Assuming that the majority of those at risk don’t make it and close, we can be looking at 1M of retail closures if things don’t change.

It is estimated that 10-20% of small business owners use home equity loans to finance their businesses (although this could be higher in 2024 - there’s not a lot of surveys/data). This would imply that hundreds of thousands of homeowners would be at risk of default if these businesses shut down.

Furthermore, if the average small business employs 6 people, we are well on the path to have an estimated 6M jobs lost (there are 20M total jobs in the US from retail trade SMBs)— meaning less spending, more fear, lower retail sales, and therefore tighter budgets continuing the spiral. That, on top of increasing prices from higher import costs and duties applied.

Even these shocks and uncertainty is harmful and increase risks.

What do we do

As a shopper right now, skip the big-box sales. Zara, Aritzia, Walmart, Revolve—they can afford to lure you in with discounts and absorb the risks. Small stores can’t.

If you love a small merchant, shop directly from them. If they offer gift cards, buy one—it gives them upfront cash flow. It’s a good time to purchase a gift card from your favorite small instagram brand. And unless something’s truly defective, don’t return it. Every return is a blow to their margins, especially now.

For stores, the picture is a lot tougher. Retailers must act to preserve revenue, drive cash inflows, and pivot supply chain risk down the line. Here’s a few quick wins:

1. Launch a gift card or store credit option for extra cash inflow now

Most Shopify stores offer built-in gift card features. If that doesn’t work, get creative—set up a Gumroad page or a simple donation/crowdfund option. Frame it as a rally to survive, not a charity plea. Some businesses have opened crowdfunding pages to pay the tariffs due.

2. Flag tariffs and raise prices on your site

Your customers aren’t clueless. Many will understand and support you—if you explain why prices are rising. Shopify just added a tariff pricing breakout feature. Consider adding a short note (like Realisation above) or in your product descriptions about how tariffs are affecting your business.

The opportunity cost of every item just went up. That item on your shelf? It might be the last one you’ll ever sell at the old margin. This is also the most acceptable time to raise prices — the excuse is on the headlines every day.

Campaign

Attention builds change. Email reporters in the New York Times and WSJ and tell them your story. Business owners speaking up about changes is driving positive feedback across social platforms like Instagram and Threads.

I think this would be the right time for big tech to start a fund for cash-crunched customers and support them at this time. For Google, Shopify, Meta/Instagram, Stripe, Square/Block — this would be the right thing to do, support future growth, and offer an opportunity for good PR as they built a lot of their growth on American small businesses.

If you have a small business and are open to sharing feedback with your name or anonymously, I’m putting together a list of stores that are affected and a survey with the biggest challenges HERE.